FIRE Starter

Financial Independence Retire Early, FIRE, a movement I don’t even remember where or when I met. It must have been 10 years. Probably more. It doesn’t matter.

Summed up to the bone, the gist of the movement is: Make sure you have enough to cover your expenses so you don’t have to work anymore.

As far as I’m concerned, the most attractive part is the first two letters: being financially independent. Retiring early is a consequence of that, assuming you want to.

Although I have been aware of the topic for I don’t know how long and have always kept the aspiration for independence in mind, the level of attention to the goal and effort invested to get me closer to it fluctuated. Recently, chance rekindled my interest through the (not so) invisible hand of the YouTube algorithm, together with a few chats with friends with similar ambitions.

So, taking advantage of a spike of inspiration on a spring Saturday evening, fomented by blogs and videos of people who have done the same, I decided to document my journey towards the finish flag with the fire, starting with this post.

Current situation

Let’s see where I’m (re)starting from.

Income and expenses

I make no secret of the fact that I start from a fortunate position. I’m a software engineer and left my country, Italy, a few years ago when I decided to look for better conditions. I found them rather easily. My first salary outside the Belpaese was already 75% higher than what I was earning back home. The tech industry was (and still is) a great field to be in, with significantly higher-than-average salaries. I’m not sure why that’s not the case in Italy. Whatever.

Apart from the regular salary, I receive +25% of it (turning 30 in 2024) in annual grants in the form of employer stock. In practice, how much I pocket depends on the share price when I sell them after vesting. So far, all the ones I have liquidated I have sold at a heavy loss.

Being frugal a cheapskate by nature, I have always had a good savings rate. As my salary has raised, I have not inflated my expenses proportionately, so my saving rate could only increase. I currently set aside more than 75% of what I earn. Nevertheless, I feel I have room to do better by optimizing expenses.

Investments

I’ve been investing since late 2018 following Warren Buffet’s (and many others’) advice: use passive funds that replicate the market. Unfortunately, for most of the time, I followed a Dollar Cost Averaging (DCA) plan that was far too modest compared to what I could and should have invested. I only recently realized that the strategy had two big problems and I still cry about the missed returns:

- I never stopped to reflect on what my ideal allocation was and I held an excessive amount of cash in my bank account.

- Following DCA has a lower expected return than investing as much as you can as early as you can.

After realizing my mistakes, I invested heavily, leaving enough for daily expenses and an emergency fund that I placed in a Trade Republic account to generate an annual 4% (referral link to open an account). I am left, however, with a question about the size of this fund. If I were to lose my job today, I would have enough liquidity to cover at least 12 months of expenses. Probably more. Maybe it’s too much and I’m considering reducing it.

In any case, my general philosophy now is that every dollar must have a purpose. Condensing it with what I said just above, my rule for allocating liquidity and investments is:

- Liquidity: what I need for daily expenses and emergencies

- Investments: everything else

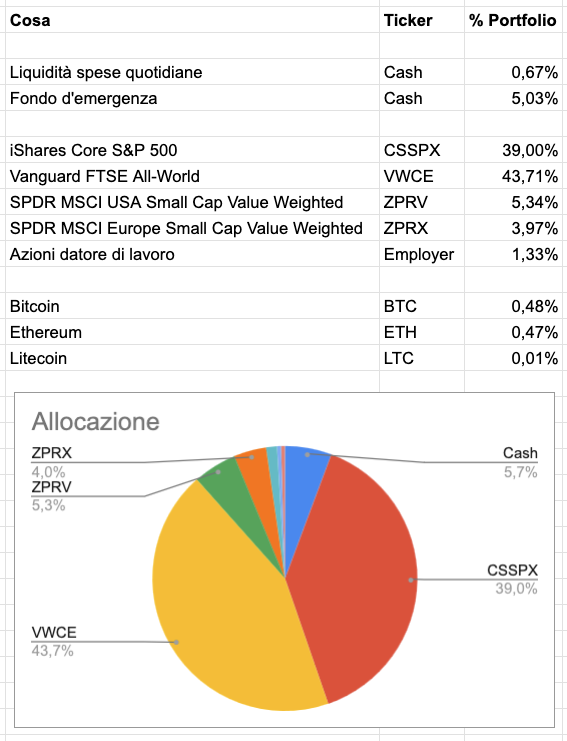

As for what I invest in, in 2018 I started by buying CSSPX, an ETF that replicates the S&P 500, i.e., the average of the US stock market, but from 2023 I switched to the trio VWCE + ZPRV + ZPRX, where:

- VWCE replicates the performance of the world (FTSE All-World)

- ZPRV replicates the performance of US small-cap value companies (MSCI USA Small Cap Value Weighted)

- ZPRX does the same as ZPRV but for European companies (MSCI Europe Small Cap Value Weighted)

Rather than the latter two, I would prefer having a “global small-cap value” ETF, which would include everything, not just the US and Europe. Unfortunately, as far as I know, there isn’t one I can buy in the EU. (No, IUSN is not small-cap value.)

My target allocation for my stock portfolio would be 90% world, 6% small-cap value US, and 4% small-cap value Europe. However I’m currently heavily biased towards the United States since I have never sold the CSSPX shares purchased before changing the allocation strategy to avoid realizing gains and losing money on taxes. Now, given that I realized some losses from selling stocks, I’m thinking I could sell some CSSPX shares: just enough to offset the losses and rebalance a bit.

I also have a fart of crypto bought between 2017 and 2018 that I remember about every N years. I am undecided whether to sell and reinvest in something else or forget about it again.

My allocation (partly in Italian, but I’m sure you understand it)

Towards FI(RE)

As I said at the beginning, what interests me most about FIRE is the financial independence part. The early retirement bit is secondary, for the time being. FI(RE), in short.

Calculation

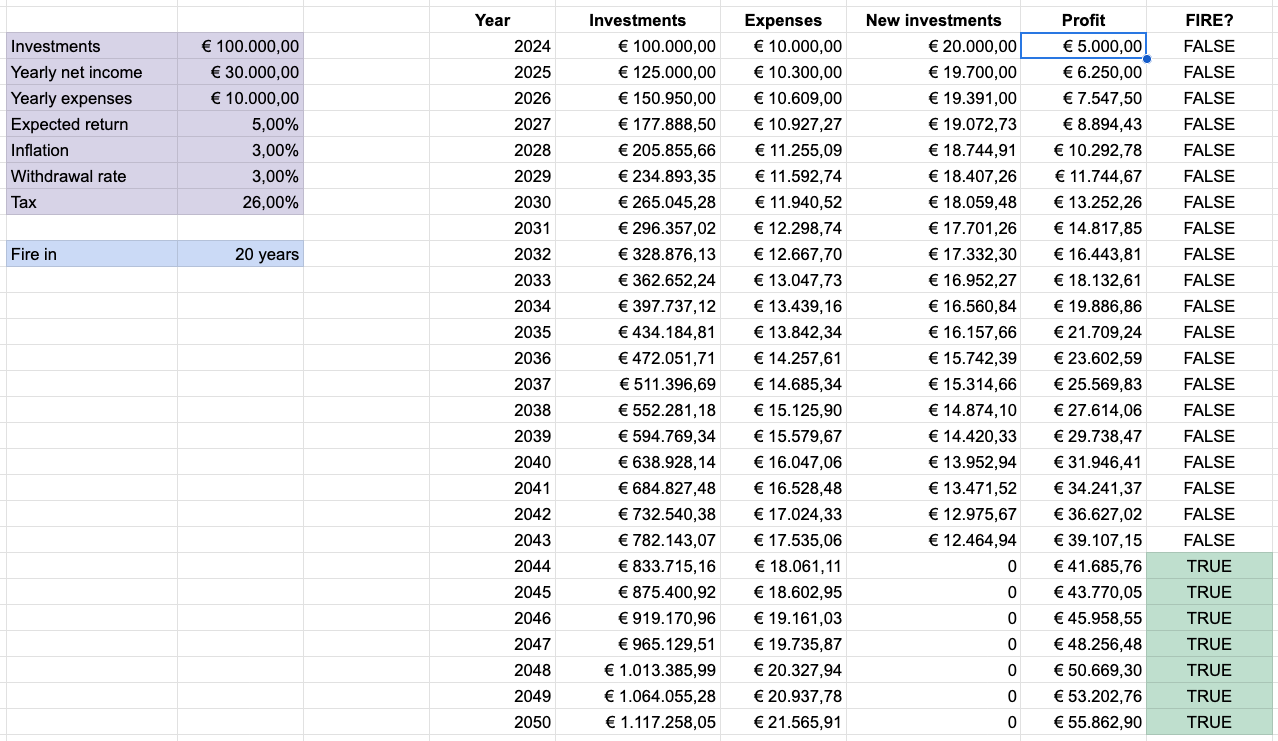

To estimate when I will be financially independent, I use a spreadsheet that tells me, based on the parameters I set, how my wealth would evolve and when it would be enough to cover my expenses without exceeding the “safe withdrawal rate”. The latter is the percentage of capital that can be withdrawn without incurring a high risk of depleting the capital before dying.

A famous rule is the 4% rule, which sets the safe withdrawal rate at 4%. Unfortunately, it doesn’t seem particularly solid and has been criticized over the years. Instead, I use a withdrawal rate between 2.5 and 3%, depending on how optimistic I feel.

Example of using the spreadsheet with made-up figures (I’m still too shy to share the real ones)

As of today, if I input my invested assets, income, and expenses, the prediction that comes out is that I can be FIRE in 11 to 17 years, depending on the values I estimate for inflation, yield, and withdrawal rate. However, we need to keep in mind that the calculations in this sheet are very approximate. Too much to base one’s life plan on. In particular:

- I assume that capital gains tax is paid on the entire withdrawn amount, whereas it should only be calculated on the actual gain (selling price - purchase price).

- I assume a fixed return rate and therefore do not take into account the “sequence of returns” risk. In real life, stock market returns are anything but constant. Even assuming the same average annual return, a scenario in which the market is down during the early retirement years and then up is more unfavorable than a scenario where it does the opposite. This is because, if the market is initially down, the early withdrawals will have a significant negative impact on future returns.

What I should do, rather, is simulate N different sequences of market returns and, for each of these, calculate in how many years I would be FIRE. In the end, for each period, I would have the probability of success. Something like:

- Probability of success after

- 1 year: 0%

- 2 years: 2%

- …

- 10 years: 60%

- etc.

In any case, estimating more accurately how long it will take me to reach the goal is not urgent. We’re talking years anyway. For the time being, the calculation I use is more than enough to give me an rough idea and support my next steps.

Next steps

Precise calculations or not, there are several things I can focus on to move towards FI(RE). For example (and not necessarily in order of priority):

Define my goals more clearly.

Okay, I want to become independent, but aside from that? What kind of life do I want?

Adjust expense estimates based on goals.

Although I currently spend X, it doesn’t mean this is the correct amount for the situation I’m aiming for. This means at least two things:

- I might need to add to my estimate some expenses that I don’t have yet but expect to.

- I might realize that certain expenses are not in line with my goals and therefore cut them.

Optimize expenses.

While keeping the goals in mind, I might have room to optimize expenses both in the short term and in the target situation. More than one road leads to the same destination.

Integrate the big two.

Home and car ownership most likely won’t be among my goals. But since they are significant expenses and the likelihood of changing my mind is not zero, it’s worth estimating what impact they would have to know how much the forecasts would change.

Investigate how to create extra income.

Cutting expenses is one of the two sides of the wealth accumulation coin (and thus of the push towards FI). The other is increasing earnings. Moreover, if I have earnings coming from more than one source, I increase the diversification of my income, and the risk of adverse events is reduced accordingly.

Investigate risks and plan mitigations.

I need to have strategies that allow me to answer questions like:

- What if I encounter an unfavorable sequence of returns?

- What if the market doesn’t perform as well as in the past?

Furthermore, I need to understand what additional risks I should take into consideration.

In conclusion

I still have a lot of work to do, but I want to do it (so far). My idea is to document the journey along the way, through this blog and newsletter. I already have various ideas on what to write about — for example, my progress in the steps listed above — and their number will only increase. Actually, on that note, if you have suggestions or questions, feel free to write me at [email protected].

For now, let’s end this first ramble. I’ll leave you with a list of resources that are part of my more recent life — finance and FIRE realm:

- Early Retirement Extreme (I’m currently reading the book)

- Paolo Coletti (Italian — a recently-discovered love of mine)

- Mr. RIP (Italian — a discovery from many years ago, when his podcast was still a work in progress)

- The Bull Podcast (Italian)

- Ben Felix

- Rational Reminder Podcast

Adiós.