How I invest following Warren Buffett's dead-simple advice

I invest regularly, but I don’t think about it 99.97% of the time.

This may sound odd if you think investing is complex. Maybe you are bombarded with “investment companies” spam (I know I am), and you developed a repulsion. Or maybe you believe you’d need to become an expert and waste your days looking at charts.

Nah. That’s not for me.

I follow an extra-simple rule that I stole from the magical Warren Buffett.

If you don’t want to devote your time to finance, his advice is to invest in a passive fund mirroring the S&P 500 index.

Passive fund? Index? S&P 500? ?? ?

Calm down, my friend. It’s easier than it seems.

Indices and passive funds

I’m sure you happened to stumble upon strange names like “Dow Jones Industrial Average” or “S&P 500”. They are usually called into question in the news when talking about movements of the stock market.

Dow Jones Industrial Average and S&P 500 are indices.

An index is a way to follow the trend of a market.

Let’s say I want to have an overview of how well the banana market 🍌 does over time. I could look for data about all companies in the banana market and analyze it. However, this process is a bit too laborious for my taste. I only need an overview.

A more agile option is to check if there’s an index I can use.

An index is like a basket. More specifically, it’s a formula that defines what the basket contains. Think of it as a recipe: it tells you what belongs to the basket and in which proportion.

The total value of the basket is a number that summarizes the market it refers to.

Let’s invent an index for the banana market. We call it BNaNa, and its composition is:

- 40 × Banana Inc.

- 30 × Banana Brothers

- 20 × Banana company

- 20 × Bana & nana

The value of the index will be the result of this formula.

I don’t need to do any manual analysis to understand how the banana market is doing. I just need to look at the trend chart for the index.

Dow Jones Industrial Average trend

There are indices for all kinds of markets: energy, banking, food, European, Chinese, etcetera, etcetera.

Some noteworthy ones:

- Dow Jones Industrial Average: it tracks 30 big US companies.

- MSCI World: as the name suggests, it’s a summary of the global economy.

- Standard and Poor’s 500 (aka S&P 500): it’s often used as the average for the US market, as it includes the 500 US companies with the highest market cap, i.e., the most valued ones.

The S&P 500 is the one Buffett mentions. So he is suggesting we invest in it.

The problem is that you can’t invest directly in an index. As we saw, an index is a formula that spits out a number. It’s not an entity you can buy.

This is where passive funds come into play.

A fund is a collective investment system in which the money of multiple investors is used to buy assets like stocks, bonds, currencies, commodities, etc.

A fund is passive when it just mirrors the composition of an index. So the decision on what to buy and sell is not made by people.

A passive fund that mirrors the S&P 500 will buy and sell stocks to get to the same composition as the S&P 500.

Nothing mystical; it’s just a copy.

We are now ready to understand Buffett’s advice. Investing in an index fund mirroring the S&P 500 means betting the average of the US market will follow a positive trend.

But wait, this also means that I would get average returns. Why settle for that? It doesn’t seem very smart.

Why not investing in an active fund managed by competent human beings that work to beat the average?

To answer these questions, let’s bring up Buffett again.

A one million dollar bet

In 2007, Warren Buffett bet a million dollars.

To be fair, one million dollars is not that much for one of the richest men in the world. But Mr. Warren doesn’t care about the money. He wants to prove a point. He wants to prove it’s not a good idea to put your money into an active fund.

In fact, the bet (more or less) says:

Build a basket of active funds. I will choose an index fund that mirrors the S&P 500. I bet $1,000,000 that, in 10 years, the fund I choose will yield higher returns.

Protégé Partners, a company specialized in investing in funds, accepts the challenge.

I’m sure any sane person would look at this bet and say it’s completely crazy and unbalanced.

On one side, you have a dumb fund that follows the market average.

On the other side, you have a basket of active funds chosen by a company that does that as a job. Funds managed by real people who analyze and study the market to understand where to invest. People paid precisely to beat the average.

What would be the point of paying the high fees of an active fund if it yielded average or lower than average returns?

Yet this was Buffett’s bet.

And he won.

In the 10 years of the bet, the fund Buffett chose averaged 7.1% per annum. The basket Protégé made averaged 2.2%.

Sorry, what? How is it possible that actively managed funds do worse than the market average?

Some reasons:

- Consistently beating the market is hard, even for experts.

- Often, fund managers are pressured into investing more or less like the average. An eccentric manager could lead investors to withdraw their money from the fund.

- To pay the people that work there, active funds have high commissions that impact net returns.

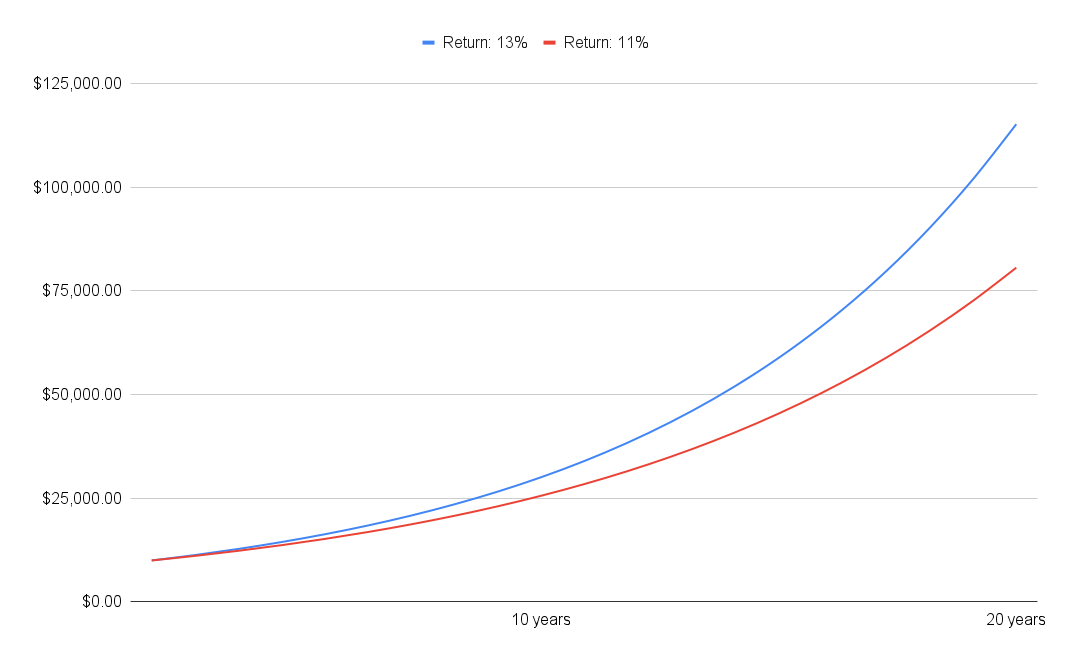

Let’s analyze, as an example, the influence of a 2% annual commission on a $10,000 investment.

Let’s say we invested 10 years ago in an index fund mirroring the S&P 500. The annual return in this crazy-market period was around 13% (assuming we’re reinvesting dividends). This means that after 10 years, our $10,000 became about $34,000.

Now let’s say we invested the same amount of money in an active fund with the same total return, but with a 2% annual fee. The net return would then be 11%. After 10 years, we end up with about $28,000. We lost $6.000 because of the commission.

And due to compound interest, the situation becomes more tragic the more time passes. After another 10 years with the same returns, we would have reached ~$115,000 on the one hand and ~$80,000 on the other.

A whopping thirty-five thousand dollars difference.

Unless the active fund does way better than average, it will never yield better returns than a passive fund which has tiny commissions in comparison.

What I do and alternatives

As I mentioned at the beginning, I follow Buffett’s advice to the letter. I buy a low-cost ETF that mirrors the S&P 500.

ETF stands for Exchange-Traded Fund, and it means a fund whose shares are traded on the market as if they were regular shares of companies. This is in contrast to traditional funds that you join by entrusting your money directly to the fund.

So every month, I open my bank’s website and buy some shares of the ETF I chose. I’ve been doing this for quite some time, and the only “regret” I have is not having started earlier.

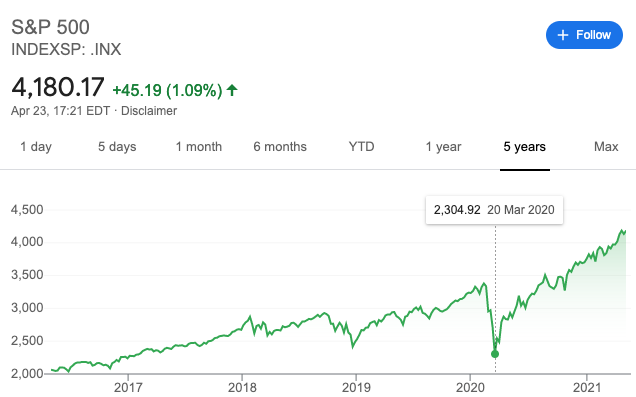

My thought process was that it was worth waiting for a recession so that I could buy low. The market was, and is, on a crazy rise.

The recession never arrived.

There was a drop because of COVID, but the situation stabilized after a few months. Who knows when the next recession will arrive.

Anyway, this is what I do, but you have many alternatives.

If you want to buy ETFs, there are many to choose from, like the MSCI World we mentioned above, which is even more diversified than the S&P 500.

Or you can turn to companies that provide Robo-advising (aka Robo-investing) services. It means that the advice comes not from human beings but from software. You set your goals, and the software generates a suitable portfolio.

Robo-advising is somewhere between active and passive funds. The fees are lower than in an active fund and higher than in a passive one. Human intervention is limited, but there are still costs to pay.

For example, Betterment charges a 0.25% commission. This is in addition to any fees in your portfolio. So if the funds in your portfolio have a total commission of 0.10%, you will pay 0.35% annually.

I don’t have firsthand experience with Robo-investing because it’s not very convenient where I live (Italy & Spain). But it’s ideal for those who want to avoid active funds but, at the same time, don’t want to manage their investments directly.

Another option is to turn to an independent financial advisor.

I repeat: independent financial advisor.

Don’t use the advising services your bank provides because they are affected by a conflict of interest. Those advisors are paid to suggest investments that are profitable for the bank, not necessarily for you.

Instead, you pay your independent advisor, so they have every interest in giving you the best advice for your situation.

Well, assuming you choose a competent one.

In conclusion

If you haven’t yet, you should start investing. In this post, I explained my dead-simple strategy: applying Buffett’s advice.

In summary:

- An index represents the average of a market.

- A passive fund mirrors an index and therefore has much lower costs than an active fund.

- Buffett advises “laymen” to invest in a passive fund mirroring the S&P 500.

- Among the alternatives, you have Robo-investing and independent financial advisors

It wasn’t that hard, after all.